December 15, 2025

Echo45 Advisors Investment Committee

For long-term investors, the Federal Reserve plays a key role in supporting the economy and financial system. This will be especially important in 2026 since Jerome Powell's term as Fed Chair ends in May, creating an opportunity for the White House to reshape the central bank's leadership and direction. This could have implications for interest rates, the stock market, and portfolios.

While headlines often focus on the Fed's next rate decision, much of the debate on both Wall Street and in Washington is around what the Fed’s role should be. The Fed’s mandate has evolved over time in response to financial crises and business cycle trends. For many investors, this can be a controversial topic, with natural disagreements over the scope of the Fed’s authority and what policy actions it should take today on interest rates and the money supply.

Looking ahead into next year, these topics matter because they shape not just near-term policy decisions, but the future of the Fed itself. What context do investors need as Fed headlines dominate the news in the coming months?

The Fed's role has expanded over history

The Federal Reserve wasn't established until the Federal Reserve Act of 1913, the third attempt at creating a central bank for the United States. The Fed is not a branch of the federal government, nor was it created by the Constitution. So, there are three broad challenges that are often raised when it comes to Fed independence: 1) its responsibilities have expanded significantly over time, 2) Fed officials are not directly elected by voters, and 3) elected politicians often prefer lower interest rates to support economic growth and employment.

When Congress first established the Fed, its primary mission was to prevent bank panics. Throughout the 19th and early 20th centuries, these panics were common and problematic for businesses and everyday Americans alike. The worst crises of that era include the Great Depression, the Panic of 1907, the Panic of 1893, and many more. Typically, these occurred or were made worse when there was a “run on a bank,” a situation in which depositors lost confidence and rushed to withdraw their money, threatening both the bank and the broader financial system.

While economic and financial challenges have not gone away, these particular types of crises are less common today. The Fed is tasked with ensuring that banks have enough capital reserves and, more fundamentally, the Fed also serves as the “lender of last resort.” That is, it acts as a backstop in situations when a panic might occur. Knowing that the Fed is ready and willing to step in can help ensure that the financial system remains stable and that transactions occur in an orderly manner. This was tested most recently during the 2020 pandemic and the 2023 regional bank crisis.

Over the decades, however, the Fed's responsibilities have grown. The Federal Reserve Reform Act of 1977, which was enacted during a period of high inflation and unemployment, directed the central bank to promote "maximum employment, stable prices, and moderate long-term interest rates." The Fed typically focuses on the first two as its "dual mandate,” and sees the third goal as a result of achieving them.

This evolution is often described as “mission creep,” since the Fed is now seen as managing not only banks, financial transactions, and the dollar exchange rate, but the state of the economy as a whole. Right or wrong, this is why there is so much attention placed on each of the Federal Open Market Committee’s (FOMC) interest rate decisions, not only for the path of rates, but for hints as to how the Fed is thinking about the broader economy.

Fed independence involves tradeoffs

Fed officials are appointed by the president and approved by Congress, but are not directly elected by voters. Critics argue that the Fed amounts to an unelected body with enormous economic power that affects all Americans. Proponents argue that the Fed must often make unpopular decisions, including ones that may slow the economy in the short run to preserve growth in the long run. There is truth to both arguments, so maintaining a balanced view can be difficult.

The 1970s and early 1980s typically serve as a positive example of this tradeoff. During that decade, economic shocks and political pressure for easy monetary policy contributed to "stagflation,” the combination of high inflation and high unemployment. Eventually, Fed Chair Paul Volcker raised rates dramatically, causing a recession that eventually broke the stagflationary spiral. This laid the foundation for an independent Fed over the following decades.

Of course, the Fed does not have a crystal ball and is not always correct in its assessments. Former Fed Chair Ben Bernanke famously told the economist Milton Friedman that “you're right, we did it” – referring to poor policy choices that worsened the Great Depression a century ago. More recently, many economists and investors believed the Fed was slow to react to the post-pandemic inflation that began to appear in 2021, thereby requiring sudden interest rate hikes.

Even if the Fed had perfect foresight, its policy tools are limited. The Fed primarily controls short-term interest rates through the federal funds rate. This is often referred to as a “blunt instrument” since adjusting a single policy rate cannot solve many of the underlying challenges in the economy. This includes supply chain problems beginning in 2020 that drove inflation higher, trade uncertainty due to tariffs, or potential labor market challenges due to artificial intelligence.

Additionally, the Fed can only indirectly influence longer-term rates, which matter more for mortgages, corporate borrowing, and investment decisions. These rates are determined by market forces including inflation expectations, fiscal policy, and economic growth. So, while the Fed is often viewed as controlling the economy and financial system, it is often influencing markets or reacting to events rather than driving them.

Leadership changes could shape policy direction in 2026 and beyond

With Fed Chair Jerome Powell's term ending soon, the White House is expected to name a replacement early in 2026. At the moment, the frontrunners include Kevin Warsh, a former Fed governor, and Kevin Hassett, Director of the National Economic Council at the White House. Much could change between now and the final decision, and the frontrunners have shifted in just the past few months.

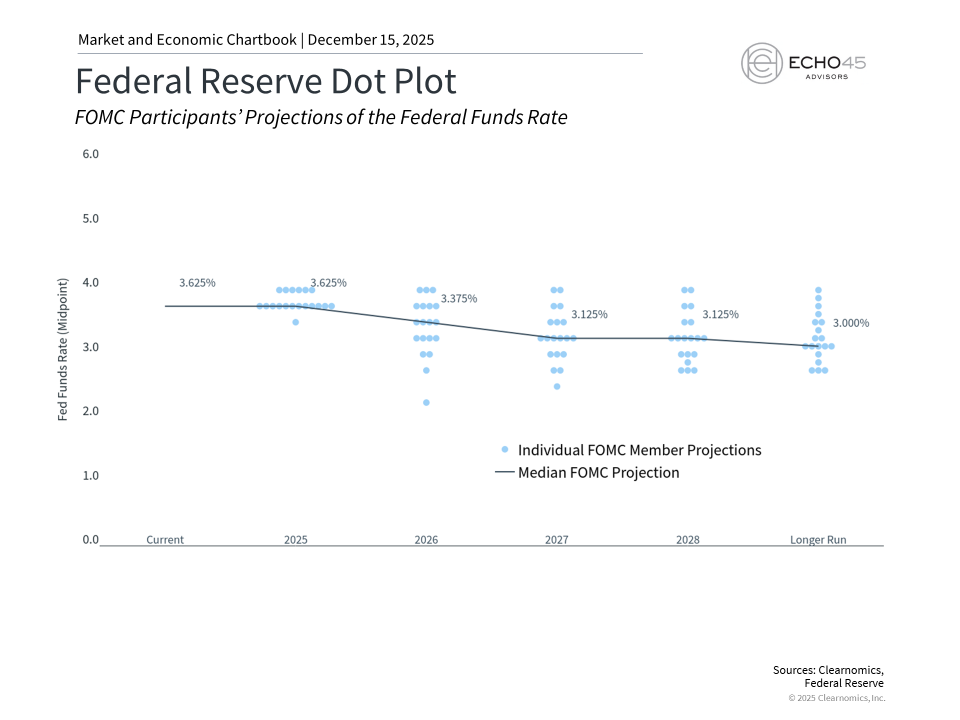

The chart above shows the FOMC’s latest Summary of Economic Projections. These figures suggest the Fed may cut rates only once in each of 2026 and 2027. Regardless of who the next Fed Chair nominee will be, it’s likely that the administration will appoint someone inclined to keep policy rates lower. This means these projections may change in the coming months.

At the same time, it’s important not to overreact to potential changes in policy. While the Fed Chair wields influence over policy direction and represents the FOMC at its press conference, the committee includes twelve voting members with diverse views. This includes the New York Fed President, seven Fed governors, and four regional bank presidents which rotate annually. Historically, the Fed has tried to work toward consensus. So, even a Chair aligned with the administration’s policy goals will need to sway other committee members with economic and policy arguments.

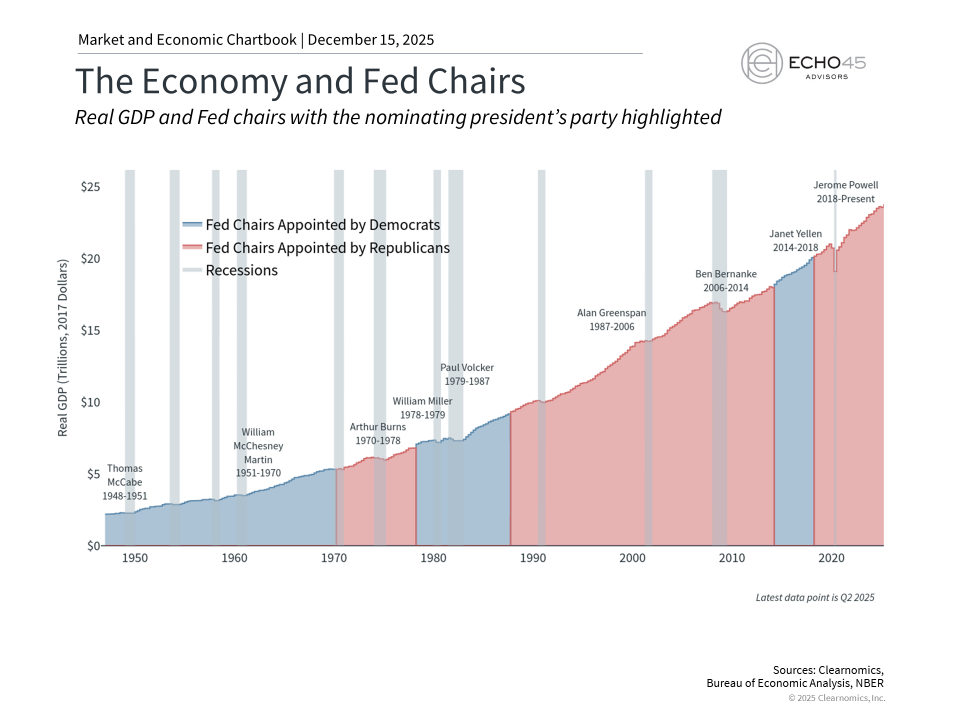

Taking a broader perspective is valuable here since this is not the first time the Fed has changed leadership. The first chart above shows that the economy has grown steadily across different Fed Chairs appointed by both political parties. It’s also important to remember that Jerome Powell was nominated by President Trump during his first term and remained Fed Chair during President Biden’s term.

What matters more than any individual Chair is whether monetary policy remains appropriate for economic conditions. Again, the Fed is often reacting to shocks outside of its control, rather than directly steering the economy.

Economic trends matter more than individual Fed decisions

While there will be many more headlines around Fed leadership in the coming months, what truly matters is the overall path of the economy. The next Fed Chair may generally prefer lower interest rates, but this will depend strongly on whether the job market remains weak and if inflation continues to stabilize. For investors, the key is to maintain a portfolio aligned to financial goals rather than react to the day-to-day speculation around the Fed.

The bottom line? History shows that markets have performed well across different Fed Chairs and policy approaches. For investors, focusing on long-term trends is still the best way to achieve financial goals.

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.