January 20, 2026

Echo45 Advisors Investment Committee

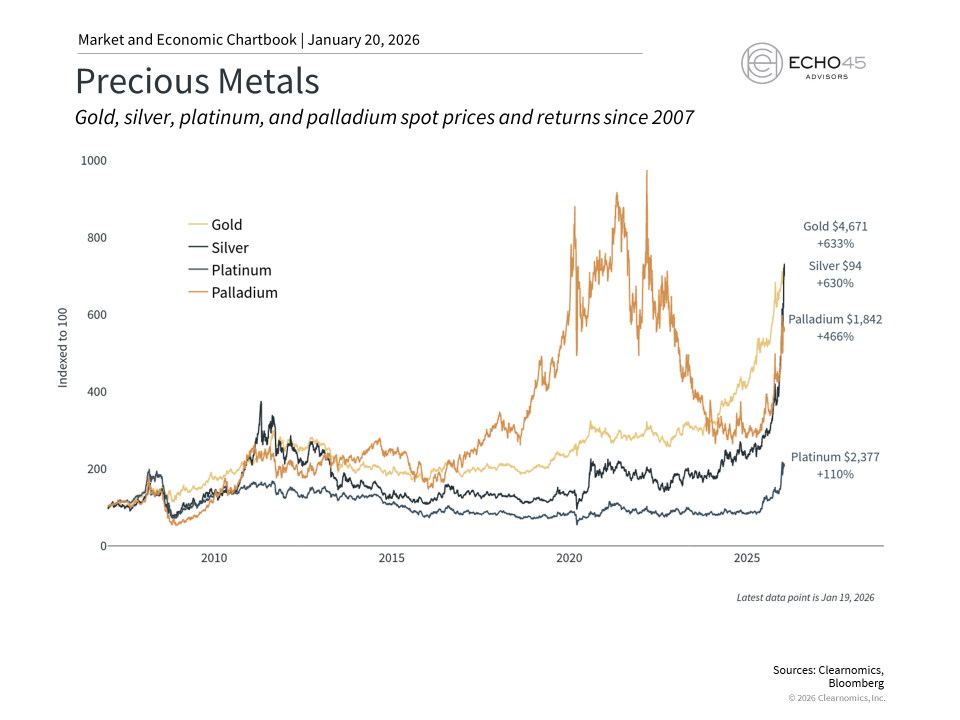

Gold, silver, and other precious metals have rallied over the past two years, capturing investor attention. Gold recently surpassed $4,700 per ounce while silver now trades above $90 per ounce, marking historic milestones for both metals. This strong recent performance may lead some investors to wonder whether they should be investing in these assets. As with all investments, it's important to maintain a broader perspective to understand their history and how they fit into a well-constructed portfolio.

While many investors often turn to precious metals as "safe haven" investments, these and other commodities are prone to boom and bust cycles. In today's environment, the rallies in gold and silver are occurring alongside many other asset classes due to heightened uncertainty around monetary policy, fiscal policy, and geopolitical risk. It's important to view these assets not as speculative trading instruments, but as components of a broader investment strategy aligned with financial goals.

Precious metals often respond to uncertainty

Several factors have driven the surge in gold and silver prices. One of the most important has been the recent tension between the White House and the Fed. This has raised questions about central bank independence and the direction of monetary policy, especially as Jerome Powell's term as Fed chair ends in May 2026. Lower rates and the prospect of inflation put downward pressure on the dollar, so it's natural for some investors to seek assets that can serve as a "store of value."

Equally important is that central banks around the world have been consistent buyers of gold in recent years as they have diversified away from dollar-denominated reserves. Central banks need to hold enough reserves to manage their monetary policy and maintain the value of their currencies. These purchases of gold and other assets have accelerated amid heightened geopolitical uncertainty and concerns about currency stability.

Both metals have also benefited from their industrial applications, including in electric vehicles, solar panels, and artificial intelligence hardware. Thus, they serve roles as precious metals, safe haven assets, as well as industrial commodities.

Precious metal rallies are difficult to predict

Throughout history, periods of monetary policy uncertainty have coincided with strong precious metals performance. In the 1970s, for instance, both gold and silver climbed dramatically as stagflation hit the economy, peaking around 1980. Similarly, both rose from 2008 to 2011 during the global financial crisis, and then again during the 2020 pandemic.

In each of these cases, investors turned to precious metals when uncertainty about monetary policy and economic conditions peaked. However, both gold and silver prices began to reverse soon thereafter once conditions began to improve.

This creates at least two challenges for investors who are attracted to these investments based on recent performance. First, attempting to forecast gold and silver prices amounts to predicting the path of interest rates, inflation, and other factors like terms of trade. As the past several years have shown, these factors are difficult to forecast with certainty. Many concerns among investors and professional economists as inflation spiked in 2021 and 2022 did not materialize as expected.

Second, while it's understandable that investors are drawn to assets that have performed well, history shows that precious metal rallies are notoriously difficult to time. The 1970s gold rally, for instance, was followed by two decades of declining prices. Gold peaked above $800 in 1980, a level it wouldn't reach again until 2007.

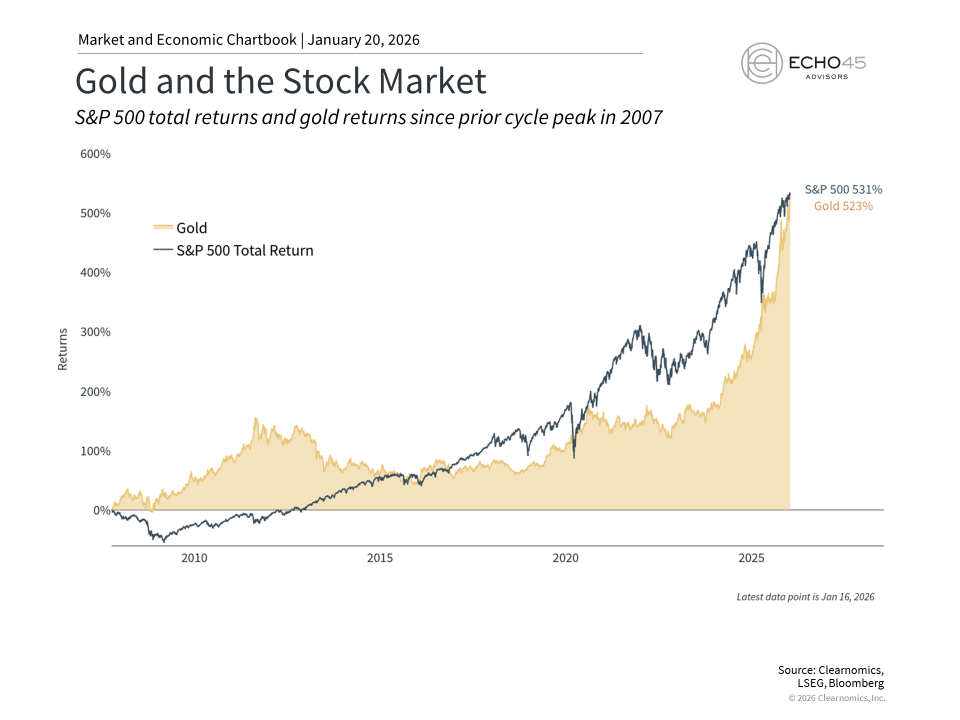

The accompanying chart shows gold's performance compared to the S&P 500 since the 2007 market peak. While gold has had periods of strong performance, the stock market has also performed well over these periods. For investors focused on recent precious metals rallies, this longer-term perspective may seem surprising. However, it makes sense since the stock market has historically risen over long periods of time.

This pattern extends to silver as well. Despite its strong industrial demand story, silver has experienced long periods of underperformance between rallies. For instance, silver experienced a strong rally in the late 1970s. As stagflation pushed silver higher, a famous episode occurred in which the Hunt brothers attempted to corner the market by accumulating stockpiles and buying futures contracts. While they drove prices higher for a time, prices eventually plummeted as new supply entered the market and when regulators introduced restrictions on leveraged buying of commodities.

Other precious metals exhibit similar behavior. Between 2016 and early 2022, palladium gained over 500%. This rally was driven by restricted global supply and greater use in applications such as catalytic converters for cars. However, after peaking, prices declined sharply over a two-year period.

Precious metals should be aligned with financial goals

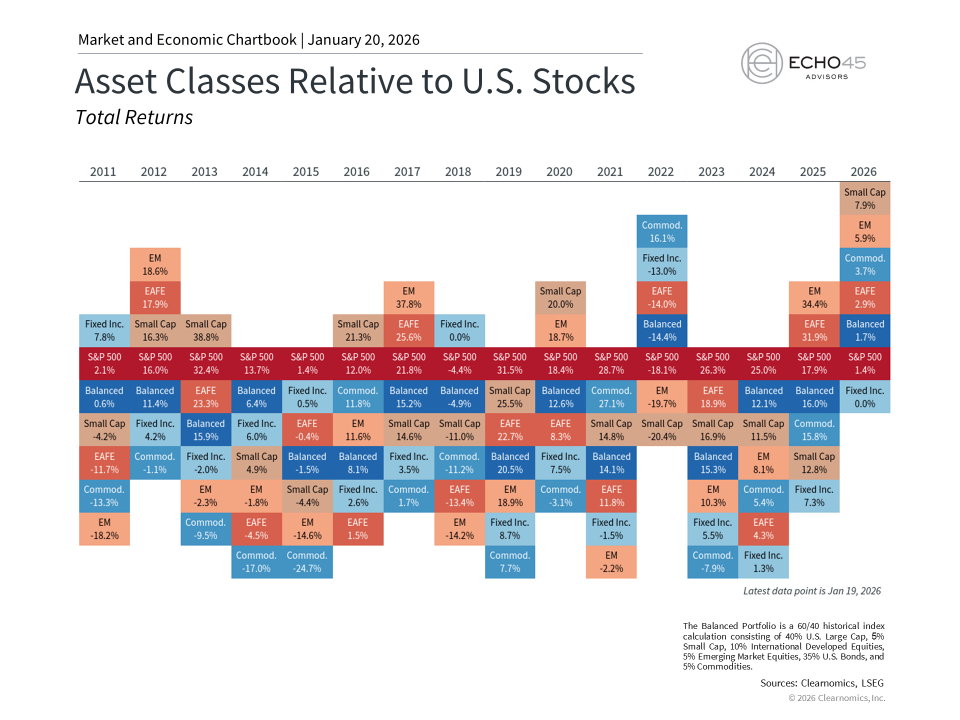

These episodes demonstrate that, in situations where it makes sense for investors to have exposure to precious metals and commodities, gold and silver are best viewed as components of a broader commodities allocation or as part of alternative investments. The Bloomberg Commodity Index, for instance, currently allocates 14.9% to gold and 3.9% to silver, alongside other commodities such as industrial metals, energy, and agricultural products. This diversified approach to commodities exposure helps manage the volatility inherent in any single commodity.

The case for including precious metals in portfolios is based on the fact that they behave differently from stocks and bonds. Their value derives from scarcity, their roles as stores of value, and industrial uses. This means they often react to market and economic events differently from traditional asset classes, which can help to stabilize portfolios.

However, precious metals also carry important limitations. Most notably, they generate no income, unlike bonds or dividend-paying stocks. This lack of income also makes these assets difficult to value, which is another reason they are prone to booms and busts. A portfolio inappropriately weighted toward gold and silver may sacrifice the long-term growth potential of equities and the income generation of fixed income. So, even if precious metals might help in specific market environments, they may not be aligned with long-term goals.

The accompanying chart shows that many asset classes have contributed to portfolio returns recently, not just precious metals. While gold and silver have certainly performed well, there will always be individual investments that shine in particular periods. The key is constructing portfolios that can benefit from various market conditions rather than concentrating on recent winners.

The bottom line? Gold and silver have experienced rallies over the past two years, but long-term investors should view them in a portfolio context. Their value lies not in their recent performance, but in how they contribute to portfolio balance across different market environments.

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.