July 28, 2025

Echo45 Advisors Investment Committee

While investors always look to corporate earnings for clues about how businesses are performing, the current earnings season arguably carries greater importance due to tariffs. Although major stock market indices have reached new all-time highs as trade tensions have stabilized, there is still uncertainty as to how tariffs might affect consumers and businesses. Fortunately, new trade agreements are being announced, and corporations are reporting earnings that are beating expectations.

The latest figures show that consumer spending remains healthy and corporate earnings growth continues to exceed expectations. According to the Yale Budget Lab, consumers face an overall average effective tariff rate of 20.2% as of July 23, the highest level since 1911.1 The fact that this has not appeared in the consumer spending data suggests that some businesses are absorbing the cost of tariffs instead of immediately passing costs to customers. Companies appear to be able to do so because of strong earnings growth and healthy profit margins.

Specifically, with just over a third of S&P 500 companies having reported earnings results for the second quarter, 80% have delivered positive earnings-per-share surprises, and the blended earnings growth rate of 6.4% has exceeded expectations of 4.9%, according to FactSet.2 While this growth rate is lower than in recent quarters, it suggests that an “earnings recession” – i.e., a sharp drop in corporate profits such as in 2020 or 2022 – is less likely than originally feared.

Corporate earnings are beating expectations so far

How are tariffs paid, and how might they show up in the numbers? Although tariffs are collected as revenue by the government, the true costs are shouldered either by those that export to the U.S., or by U.S. consumers and businesses in the form of higher prices. How much each group pays depends on their “pricing power.”

For example, the U.S. relies on materials known as “rare earth metals” for electronic devices, nearly all of which are imported. Since there are few alternative sources, any tariffs would likely be passed directly to consumers. This is one reason the administration has sought an agreement that expands imports of rare earth metals with China, and why there is greater interest in domestic production.

In contrast, the automotive industry is highly competitive with both domestic manufacturers and many countries that seek to export vehicles to the U.S. If tariffs are imposed on cars from one country, those manufacturers may choose to absorb some of the costs to remain competitive with vehicles from other nations and domestic producers.

So, in the short run, the effect of tariffs depends on factors such as how competitive an industry is, and whether consumers and businesses have options. In the longer run, supply chains can adapt to new conditions and currency values can adjust.

Therefore, the impact of tariffs on earnings, and the response from companies, varies greatly by industry. For instance, General Motors reported that tariffs cost $1.1 billion in profits during the second quarter, with profit margins falling from 9% to 6.1%.3 On the other hand, Cleveland-Cliffs, a flat-rolled steel maker in the U.S., announced better than expected earnings for the second quarter, benefiting from tariffs that reduced steel imports.4

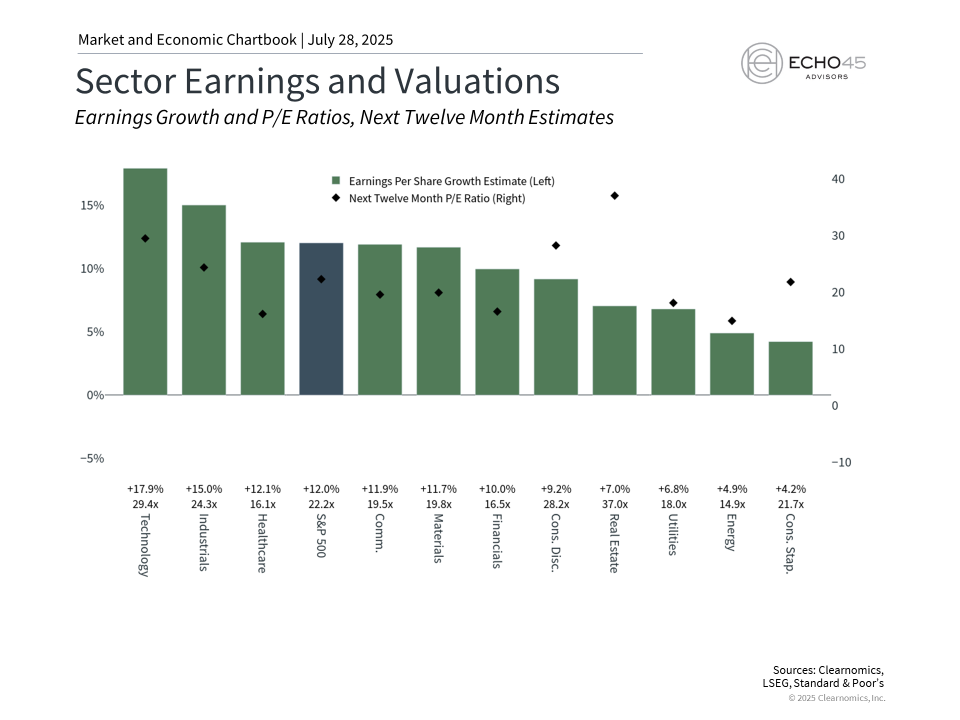

The chart above highlights the fact that earnings expectations vary greatly across sectors, partly due to the impact of trade. It may take several quarters to understand the full effects of tariffs on companies, especially as new trade agreements are announced.

Several countries have agreed to new arrangements, some with significantly lower tariffs than originally declared on April 2. It was recently announced that the European Union and Japan will face 15% tariffs for goods exported to the U.S., and Indonesia and the Philippines will face 19% tariffs. Meanwhile, discussions with China are ongoing after earlier developments on a trade truce.

Markets continue to reach new all-time highs

Markets have continued to reach new all-time highs as earnings beats are reported and new trade deals are announced. As the chart above illustrates, the S&P 500 has reached over a dozen new record highs this year, most of which have been achieved over the past month. The Nasdaq has also hit record levels, topping its historic peak from last December, and the Dow is near a new record as well. Although markets at these levels may make some investors nervous, the reality is that major indices can reach many new all-time highs each year during market expansions.

Markets are performing well but concerns about the impact of tariffs on the economy persist. Some economic forecasts, including those by the Federal Reserve, suggest that inflation could be slightly hotter and growth somewhat slower. The impact on each industry will depend on their input costs, with those that import more facing lower profit margins. However, these estimates must be weighed against the benefits of domestic investment and the potential for companies to adapt through innovation and greater efficiency.

While tariffs are historically high, what matters more is that they are predictable, since a stable business environment allows companies to adapt their operations and supply chains more effectively. Looking further out, current Wall Street consensus estimates are for S&P 500 earnings to rise at a 9.5% annual growth rate. These same forecasts expect an acceleration in growth over the next two years as global trade stabilizes, although much could change between now and then.

Earnings are an important long-term driver of returns

The stock market tends to follow corporate earnings in the long run. The accompanying chart shows that while the price and earnings of the S&P 500 do not line up perfectly, they follow the same broad trends. This is because economic growth boosts earnings, which in turn pushes stock prices higher. So, while the economy and the stock market are not one and the same, the two are closely related through the performance of companies.

This is how the impact of tariffs on profits can affect investors. Whether the stock market is "cheap" or "expensive" depends not just on stock prices but also on corporate performance. The price-to-earnings ratio, for instance, is simply the price of a stock or index divided by some earnings measure, such as expected earnings over the next twelve months.

What this means is that even if prices don't change, increasing earnings will make the market more attractive, and vice versa. The current S&P 500 price-to-earnings ratio is 22.2x, well above the historical average of 15.8x, and is approaching the historic dot-com bubble peak of 24.5x. Current earnings trends are positive, but whether the stock market continues to be attractive will depend on economic growth and earnings.

The bottom line? The current earnings season could provide insights into the effect of tariffs on consumers and businesses. For investors, understanding these trends while staying focused on long-term planning are still the best ways to achieve financial goals.

References

[1] https://budgetlab.yale.edu/research/state-us-tariffs-july-23-2025

[2] https://insight.factset.com/topic/earnings

[3] https://investor.gm.com/static-files/eaf4a73f-ef85-4134-8533-902e6a9a8177

[4] https://www.clevelandcliffs.com/investors/news-events/press-releases/detail/678/cleveland-cliffs-reports-second-quarter-2025-results

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.