November 17, 2025

Echo45 Advisors Investment Committee

As the holiday season begins, it’s the perfect time to pause and appreciate what we have, both in our personal and financial lives. This is particularly important since investors tend to focus on what could go wrong rather than what has gone right. At the moment, with markets performing well, it’s helpful to reflect on the past year to gain perspective as new opportunities and challenges emerge.

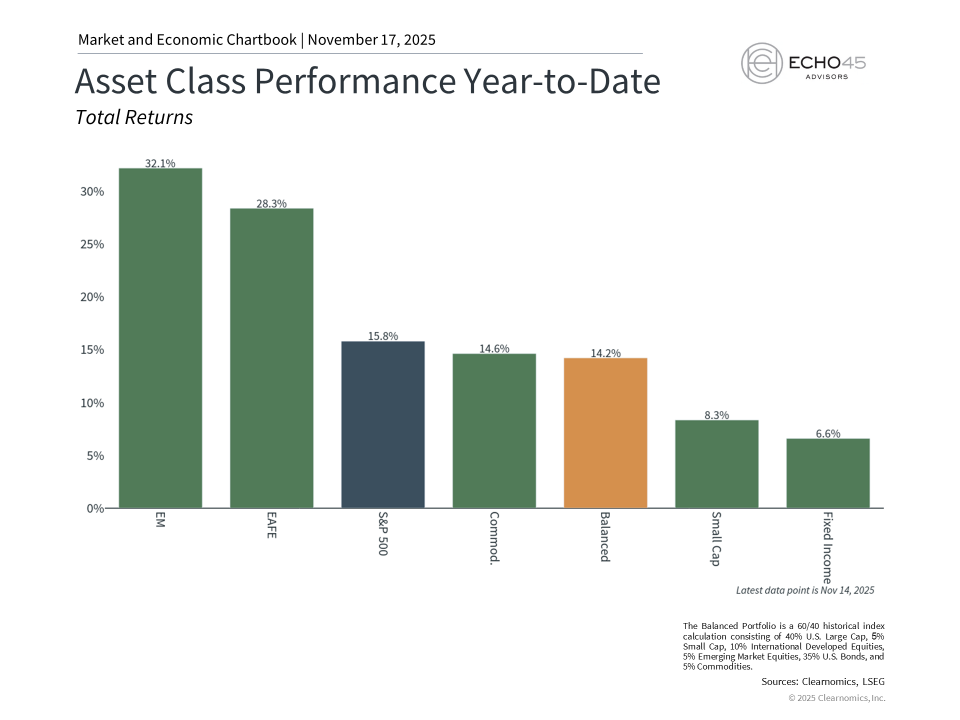

Financial markets have delivered strong returns over history, and this year has been no exception. The S&P 500 has gained over 15% with dividends year-to-date, while bonds have returned approximately 7% as measured by the Bloomberg U.S. Aggregate Bond Index. International stocks have outperformed U.S. stocks for the first time in many years. Many diversified portfolios have benefited from this broad-based performance across asset classes. What can investors keep in mind as they prepare for the coming year?

We have entered the fourth year of the bull market

First, investors can be thankful that financial markets have performed well this year despite market swings. This bull market cycle, which began after the market bottom in October 2022, is now entering its fourth year.

While past performance is no guarantee of future results, history shows that bull markets tend to last much longer than bear markets, often running for five to ten years or more. The typical bull market has delivered cumulative returns far exceeding what we've seen so far in this cycle, despite the many challenges investors faced during those times. While there are important concerns around valuations and market concentration, investing for the long term requires us to navigate all types of market conditions.

The bond market's positive returns are important to highlight after the challenging interest rate and inflation environment of recent years. As rates have stabilized and the Federal Reserve has begun easing monetary policy again, bond prices have recovered. This demonstrates why holding both stocks and bonds remains important for portfolios in terms of both balance and income generation.

This resilience underscores an important principle: trying to time markets around short-term events is not only difficult, but can be counterproductive if not considered as part of your broader financial plan. This was true even in April when markets fell close to bear market levels as new tariffs were announced. Markets not only rebounded quickly, but rose to new all-time highs. Investors who remained disciplined were rewarded, while those who reacted to headlines may have missed opportunities and, in some cases, may still be on the sidelines.

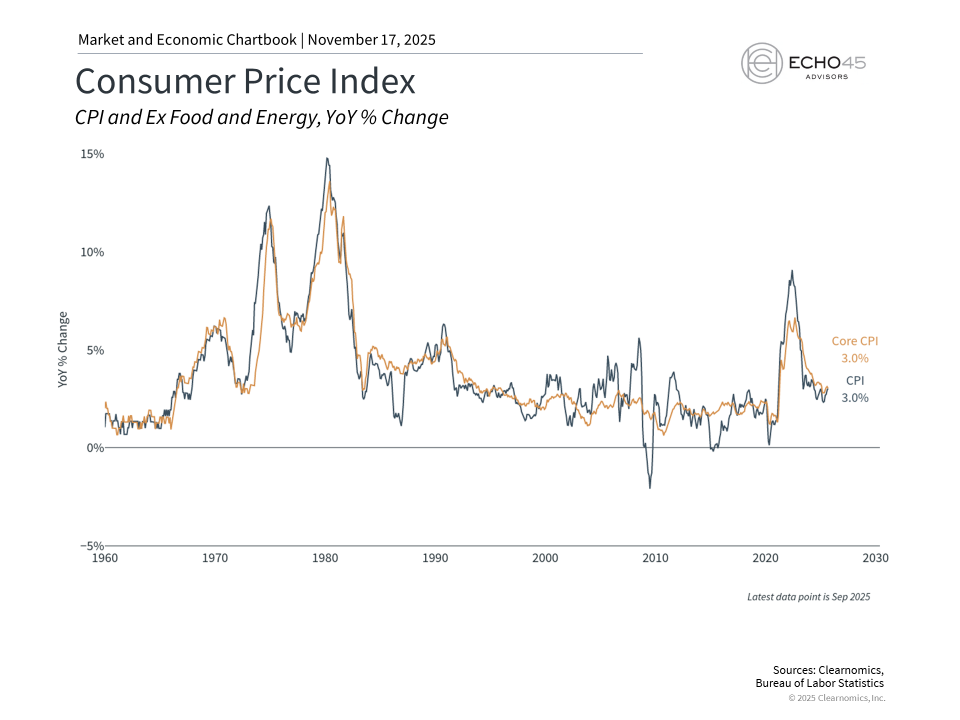

Inflation has improved and the Fed is cutting rates

Second, investors can be grateful that inflation has improved, even if progress has been slower than many would prefer. Prices have risen about 3% over the past year, which continues to be a challenge for households and policymakers. However, from an investment standpoint, inflation has been much more stable, and there are fewer fears of runaway inflation compared to prior years.

This has allowed the Fed to begin cutting interest rates after keeping them at restrictive levels for most of the year. This is also to support the job market, which has been weakening since the summer. Historically, lower rates benefit both stocks and bonds by reducing borrowing costs for businesses and consumers while making existing bonds with higher interest rates more valuable. So, even though inflation and interest rates will remain important factors for markets, fears of ever-rising inflation and interest rates appear to be behind us.

Asset allocation helps manage risk while capturing opportunities

Finally, investors should also appreciate the importance of ongoing risk management and proper asset allocation. The year ahead will likely bring new sources of uncertainty just as every year does. When this happens, there will naturally be worries about recessions, bear markets, and that the cycle may be ending. Rather than reacting to every market event, long-term investors can instead hold an appropriate portfolio that can navigate different phases of the market and economic cycle.

We can also be thankful that we have different assets available to help balance risk and reward. Risk management is important at all points in an investor’s journey, and especially so after a three-year rally. The S&P 500 price-to-earnings ratio of 22.6x is above average and steadily approaching its peak dot-com levels.

Valuations do not predict what the market will do in the near-term, so this doesn't mean markets can't continue performing well. However, it does suggest that future returns could be more modest, especially when compared with cheaper asset classes and sectors. Thus, it’s important to have realistic expectations and to hold different parts of the market with more attractive valuations.

Questions about artificial intelligence will persist. It’s natural that the effect on stock prices is difficult to predict given the transformative nature of the technology. This is similar to the challenges of predicting how the internet revolution would unfold beginning in the mid-1990s. Political volatility is also likely to continue as well with ongoing tariff changes, geopolitical worries, the growing national debt, and more. Recent history underscores that reacting to these events is not only counterproductive, but can derail financial plans.

The bottom line? The holiday season is an ideal time to reflect on the many reasons to be thankful and to review your portfolio allocations. A properly constructed portfolio balances the benefits of different asset classes and aligns them toward financial goals. This remains the key to navigating challenges and opportunities in the year ahead.

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.