September 2, 2025

Echo45 Advisors Investment Committee

The stock market climbed to new all-time highs in August, while bonds also contributed positively to portfolios. This occurred despite continued uncertainty around tariffs, Fed independence, and technology stocks. The month began with U.S. tariffs going into effect against most major trading partners after the initial 90-day pause. A federal appeals court later ruled that the “reciprocal tariffs” are illegal, possibly paving the way for the case to reach the Supreme Court.

Markets also stumbled mid-month due to concerns that the Fed could keep rates higher for longer to fight inflation. Recent inflation reports, such as the Producer Price Index, suggest that companies are beginning to pass tariff costs through to consumers. However, market sentiment quickly rebounded due to better-than-expected corporate earnings and greater confidence that the Fed will cut policy rates at its upcoming September meeting.

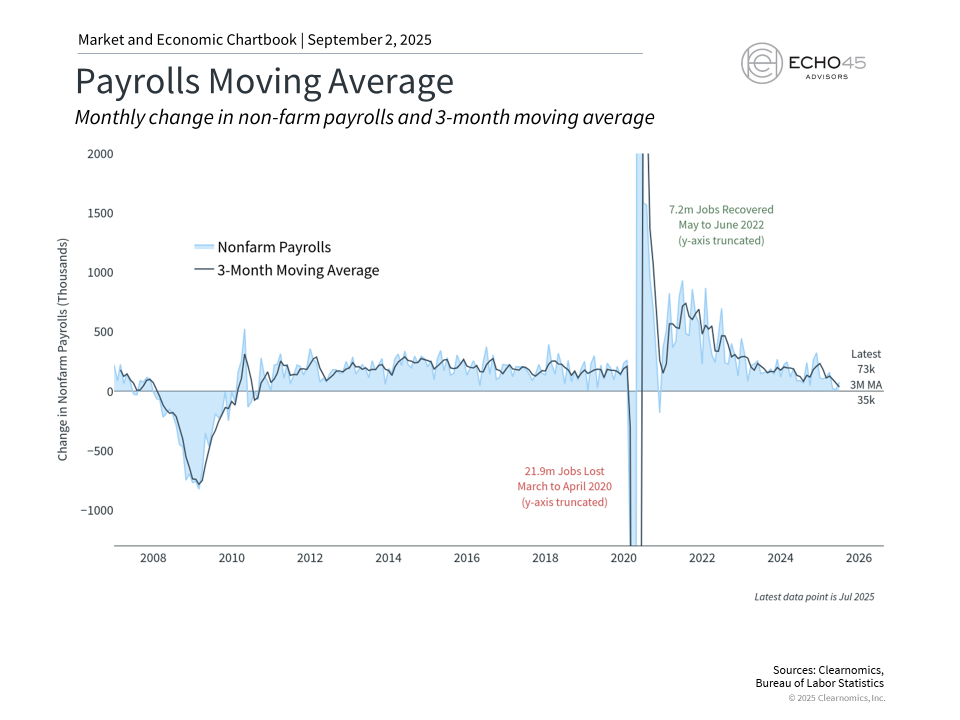

Economic figures were mixed. GDP growth for the second quarter was revised higher from 3.0% to 3.3%, a strong improvement from the first quarter's 0.5% decline. However, the jobs report published at the start of the month showed a significant decline in new payrolls, including large downward revisions to prior months. This led the White House to fire the Commissioner of the Bureau of Labor Statistics, adding to the uncertain environment.

Despite these challenges, market volatility remains low by historical standards. August's solid performance across stocks and bonds underscores the importance for investors to stay balanced and focused on the long run.

Key Market and Economic Drivers

The S&P 500 rose 1.9% in August, the Dow Jones Industrial Average 3.2%, and the Nasdaq 1.6%. Year-to-date, the S&P 500 is up 9.8%, the Dow is up 7.1%, and the Nasdaq is up 11.1%.

The Bloomberg U.S. Aggregate Bond Index gained 1.2% in August. The 10-year Treasury yield ended the month lower at 4.2%.

International developed markets jumped 4.1% in U.S. dollar terms using the MSCI EAFE index, while emerging markets gained 1.2% based on the MSCI EM index. Year-to-date, the MSCI EAFE index has gained 20.4% and the MSCI EM index 17.0%.

The U.S. dollar index ended the month lower at 97.8.

Bitcoin fell in August, ending the month at 109,127 after experiencing a “flash crash” on August 24.

Gold prices ended the month at a new all-time high of $3,487.

The Consumer Price Index rose 2.7% on a year-over-year basis in July, in line with economist expectations.

The jobs report showed that the economy added only 73,000 jobs in July. Significant downward revisions to the May and June figures mean that the labor market was much weaker than originally reported. The unemployment rate remained low at 4.2%.

Markets climbed higher on healthy earnings

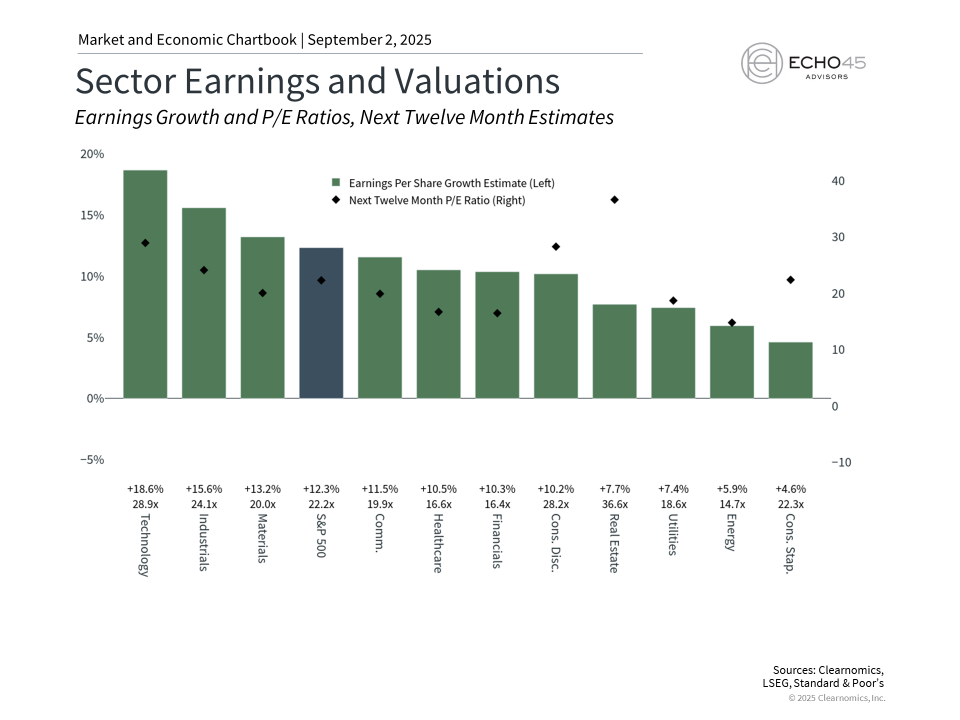

While day-to-day news and headlines can drive markets in the short run, fundamentals like earnings and valuations are what affect portfolio returns in the long run. Although stock market valuations are quite high by historical standards, this is supported by corporations that continue to grow earnings at a healthy pace.

The latest earnings season numbers show that 81% of S&P 500 companies have beaten estimates, according to FactSet.[1] This is the highest percentage since the third quarter of 2023, demonstrating that the economy and corporate fundamentals have been stronger than many expected. This also underscores the adaptability of companies as they adjust to tariffs, absorb higher costs, and find ways to grow despite policy uncertainty.

Many investors are focused on the earnings and returns of the Magnificent 7, a group of mega-cap companies, including some with multi-trillion-dollar market capitalizations. This group now represents over one-third of the S&P 500, so their performance can have a major impact on the broader market. The earnings results were mixed for this group overall, but some of these “hyperscalers” did exceed expectations. Despite concerns about an “AI bubble,” these results helped to drive a market rally in the second half of August.

The Fed is expected to cut rates

In contrast, consumer-facing businesses reported mixed results due to changing household spending patterns. This is exacerbated by the implementation of tariffs, as companies pass on a greater proportion of tariff costs to consumers. Combined with the weaker-than-expected jobs data, markets began anticipating greater rate cuts beginning in September.

Fed Chair Jerome Powell, in a speech at their annual conference in Jackson Hole, Wyoming, provided the clearest signal yet that the central bank is prepared to resume cutting interest rates after pausing this year. The Fed has a “dual mandate” to keep inflation steady and unemployment low. Recently, they have kept interest rates relatively high due to stubborn inflation and a strong job market. Thus, early signs of job market softness could tip the Fed’s decision-making toward careful rate cuts.

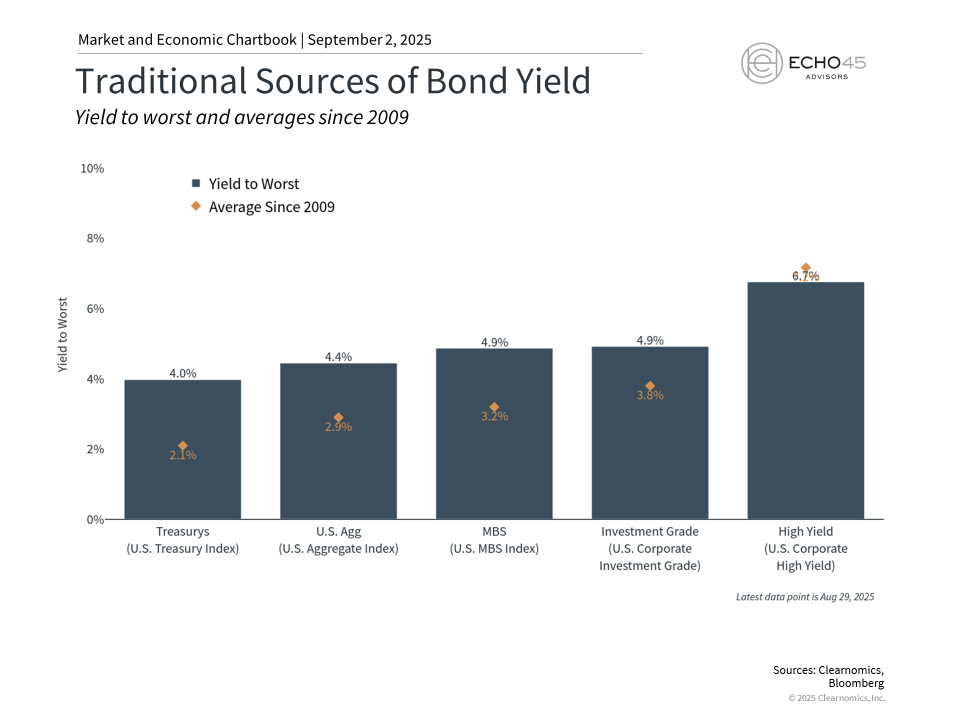

Fed rate cuts can create opportunities across asset classes

The prospect of additional Fed rate cuts could create opportunities across asset classes. In addition to supporting broad economic growth, lower interest rates can improve borrowing costs for companies, reduce hurdles for new projects, and increase the present value of future cash flows. For bonds, lower interest rates boost the prices of existing bonds that were issued at higher yields.

Bond yields have hovered in a narrow range this year, with the 10-year Treasury yield generally fluctuating between 4.0% and 4.5%. Even if short-term yields decline as the Fed cuts rates, many bond sectors are providing healthy levels of income. The U.S. aggregate bond index is yielding 4.4%, investment-grade corporate bonds 4.9%, and high-yield bonds 6.7%. These levels are well above historical averages and support balanced portfolios.

For overall portfolios, investors should continue to focus on managing the different risk and return drivers. Topics such as tariffs, Fed policy, and the risk of a government shutdown in Washington are only some of the issues that investors will face in the months ahead. Rather than reacting to each event, holding a portfolio that can withstand these swings, while providing both income and long-term growth, is the best way to achieve financial goals.

The bottom line? Markets reached new all-time highs in August despite many policy concerns. Healthy earnings and economic growth continue to support portfolios despite ongoing uncertainty.

References

[1] https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_082925.pdf

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.