July 14, 2025

Echo45 Advisors Investment Committee

One of the biggest challenges for investors is balancing long-term goals with short-term market moves. This is just as true when financial markets are rallying as when they are struggling. New developments in the stock market, cryptocurrencies, commodities, and other asset classes naturally capture investor and media attention. This can create pressure to react to daily headlines and even lead to a fear of missing out.

As long-term investors have learned over the boom-and-bust cycles of the past several decades, there are no free lunches. This is why stocks, bonds, and other asset classes remain the foundation of portfolios since they can help investors achieve the balance of risk and reward they need to reach their financial goals. In contrast, short-term market exuberance, whether it’s for tech stocks or Bitcoin, can reverse quickly and without notice.

Thus, the key to successful investing lies not in trying to time these swings, but in constructing a portfolio that can benefit from different characteristics, while maintaining focus on long-term financial plans. After all, what truly matters isn’t whether your portfolio contains the investment everyone’s talking about this week, but whether you're able to retire comfortably, provide for your family, buy a house, or give to charitable causes.

With Bitcoin surging to new all-time highs, copper reaching record levels, and precious metals such as gold and silver rising, investors face a tricky balancing act. The recent rallies in these assets reflect improving conditions that have lifted all asset classes, as well as specific policy changes in Washington and growing interest among institutional investors. How can investors maintain a portfolio perspective when considering these asset classes, rather than viewing them as standalone investments?

Bitcoin is prone to extreme swings

Bitcoin has surged to new highs as Congress considers several cryptocurrency regulations during what is being called “Crypto Week.” In particular, the House of Representatives is looking at the GENIUS Act, which would regulate stablecoins, digital currencies designed to maintain their value which are often pegged to the U.S. dollar. It will also consider the CLARITY Act, which would provide a clearer framework for regulating cryptocurrencies, and the Anti-CBDC Surveillance State Act, which prevents the Federal Reserve from creating a digital currency.

In general, Bitcoin and other cryptocurrencies attract investor attention due to their extreme market moves, growing interest among institutional investors, new vehicles such as ETFs, and concerns over fiscal and monetary trends. Many of these topics are complex and speculative. For long-term investors, the most important question is whether cryptocurrencies can play important roles in portfolios.

Whether Bitcoin fits in a portfolio depends on your specific goals and risk tolerance. The reality is that Bitcoin experiences price fluctuations several times greater than the stock market. During the 2022 bear market, for example, Bitcoin fell over 75% while the S&P 500 declined about 25%. This demonstrates that digital currencies can amplify portfolio risk during times of market stress. Bitcoin did experience a stronger rebound, but as the chart above shows, the S&P 500 and Bitcoin have behaved similarly since 2018, albeit with different paths.

It’s also important to note that not all cryptocurrencies have experienced the same price movements as Bitcoin. Ethereum, another well-known cryptocurrency, is negative this year, and has declined about 25% from its high last December. There are also countless other cryptocurrencies and “meme coins” that have followed different paths. As always, it’s important to not react to headlines and to carefully consider these assets in a portfolio context.

The copper rally reflects growth trends and tariffs

Copper, another asset that has garnered recent media attention, surged to record highs following the White House announcement of 50% tariffs on copper imports.

Copper is vital to the economy, as an industrial metal essential to construction, electrical infrastructure, electronics, and renewable energy projects. For this reason, copper is often used as an economic indicator, sometimes known as "Dr. Copper," since its price movements are sometimes used to predict economic trends.

Today, the United States relies on imports for 45% of its copper consumption, primarily from Chile, Canada, Mexico, and Peru. Tariff policies may help to spur domestic production in the long run, but will also impact pricing and supply chains in the short run. Additionally, China's substantial copper use makes the metal sensitive to global economic conditions and trade relationships.

How does this affect investors? Like Bitcoin and other volatile assets, it’s important to distinguish between sharp price movements and whether an asset fits well within a portfolio. Trying to predict the next move for copper is akin to predicting the exact path of the economy and trade policy. Instead, investors should focus on whether copper and other assets help to improve the characteristics of their portfolios, alongside other economically-sensitive asset classes, including stocks.

Precious metals like gold and silver have important considerations

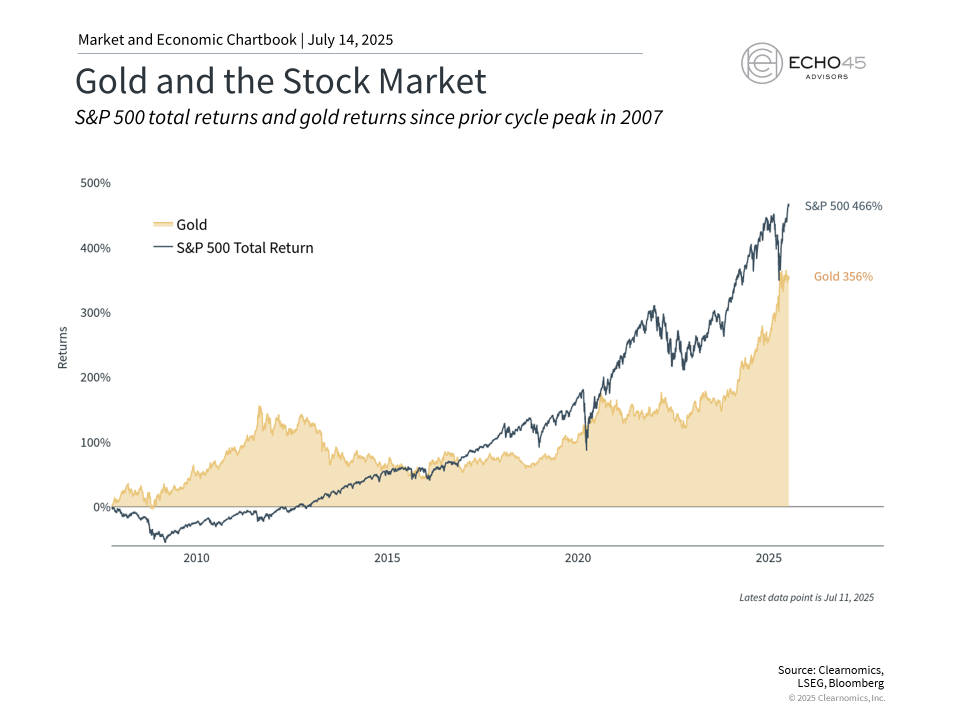

Gold and silver have also rallied recently, benefiting from their traditional roles as potential hedges against currency fluctuations, inflation concerns, geopolitical risk, central bank purchases, and more. In theory, gold and silver can also serve as a store of value during economic uncertainty although they face other challenges such as the fact that they do not generate income.

As the chart above shows, gold rose in value during periods such as the global financial crisis. However, over a longer period, the stock market has outpaced gold, even after its recent rally. During the 2010s, many expected gold to continue rising as the Fed kept interest rates low. The fact that this did not occur demonstrates how difficult and counterintuitive it can be to predict where gold will go next.

So, once again, what should matter to a long-term investor is their overall portfolio and whether it aligns with long-term financial goals. Assets like Bitcoin, copper, gold, and silver underscore both their potential benefits and the importance of thoughtful allocation decisions. At the very least, these assets should complement, not replace, diversified holdings in stocks, bonds, and other core asset classes.

The bottom line? While many assets are in the news due to their recent rallies, investors should avoid chasing short-term performance. Instead, understanding each asset's unique characteristics is the best way to align portfolios toward long-term financial goals.

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.