July 7, 2025

Echo45 Advisors Investment Committee

After months of negotiations, a new tax and spending bill was approved by Congress and signed into law by President Trump on July 4. This new budget is far-reaching, including making many parts of the Tax Cuts and Jobs Act permanent, raising state and local tax exemptions, extending the estate tax limits, and much more. It attempts to offset some of these provisions with spending cuts in key areas such as Medicaid.

This bill matters because, while trade policy has been at the forefront over the past several months, tax and spending policy in Washington has been a growing source of uncertainty for many years. While there is political disagreement with the direction of this new budget, it does take the possibility of a “tax cliff” off the table - a situation where tax policy could have changed dramatically if provisions expired at the end of this year.

On an individual level, taxes directly affect many aspects of financial planning, and the specific provisions in this tax bill have immediate implications for household finances. From an economic perspective, many investors also worry about the level of government spending, the growing national debt, and other factors that have weighed on markets over the past two decades.

Thus, there are many angles from which to view the recently passed budget. What do investors need to know when it comes to their own financial plans and what it means for markets in the years to come?

The Tax Cuts and Jobs Act rates are now permanent

The new tax bill, dubbed the “One Big Beautiful Bill” by the administration, extends and expands several key aspects from the 2017 Tax Cuts and Jobs Act (TCJA) that were set to expire. It also introduces new measures that provide other benefits to taxpayers, which are only partially offset by spending cuts in other areas. Here are just some of the major provisions that may affect households:

Current TCJA tax rates and brackets are now permanent. They were originally set to expire at the end of 2025.

The standard deduction increases to $15,750 for single filers and $31,500 for joint filers in 2025.

There is an additional $6,000 deduction for qualifying seniors (sometimes referred to as a “senior bonus”) that phases out for gross incomes exceeding $75,000. The provision expires in 2028.

The alternative minimum tax exemption is now permanent. It also increases phaseout thresholds to $500,000 for single filers, which will be indexed for inflation in the future.

The child tax credit rises from $2,000 to $2,200 per child, with future adjustments indexed to inflation to maintain purchasing power over time.

The state and local tax (SALT) deduction cap increases to $40,000 from a $10,000 limit with annual increases of 1% through 2029. It is then scheduled to revert back to $10,000 in 2030.

A deduction for tip income capped at $25,000 annually for workers earning less than $150,000, effective through 2028.

Some green energy tax credits are repealed, including for electric vehicles and residential energy efficiency credits.

The federal debt limit increases by $5 trillion. This will prevent Congress from having to debate and approve debt limit increases for some time, reducing political uncertainty.

For businesses, the bill expands tax breaks designed to encourage domestic investment and job creation.

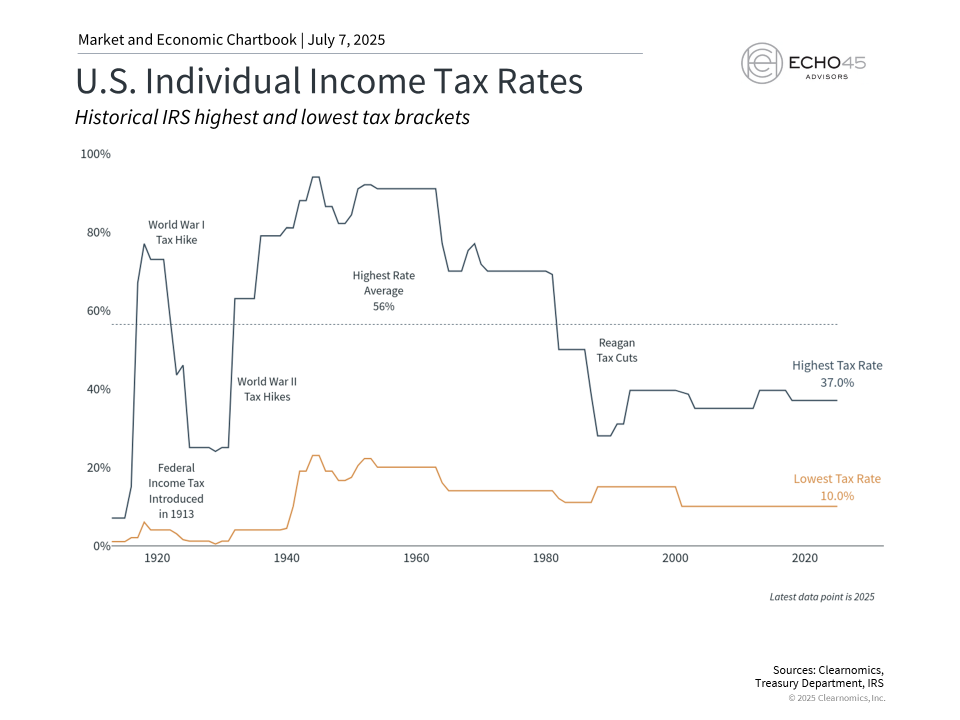

These and many other changes maintain the relatively low tax environment that has characterized the past several decades. As the accompanying chart shows, current tax rates remain well below the peaks experienced during much of the 20th century, when top marginal rates exceeded 70% and sometimes reached above 90% during wartime periods.

Growing concerns over fiscal deficits

Tax policy and government deficits are two sides of the same coin. This is because tax cuts reduce government revenues which then need to be offset by either lower spending or increased borrowing. However, most government spending is for entitlement and defense programs which are politically difficult to change. According to the Department of the Treasury, in 2025 21% of government spending is for Social Security, 14% for Medicare, 13% is for National Defense, and 14% is to pay interest costs on the existing national debt.

It's no surprise then that government borrowing has increased persistently over the past century and will likely continue to do so. The Congressional Budget Office, a non-partisan agency that supports Congress, estimates that this new tax and spending bill will add $3.4 trillion to the national debt over the next decade. This is against the backdrop of a federal debt that already exceeds 120% of GDP, or $36.2 trillion, which amounts to about $106,000 per American.

Unfortunately, there are no easy solutions to this challenge, especially because this is a contentious political topic. On the one hand, tax cuts can stimulate economic growth, which may help to offset revenue losses through increased economic activity. On the other hand, Washington has a poor track record of balancing budgets even when the economy is strong. The last balanced budgets occurred 25 years ago during the Clinton years, and 56 years before that during the Johnson administration.

It’s also important to remember that there has not always been an income tax in the United States. The modern income tax system began with the 16th Amendment in 1913 which applied modest rates to relatively few Americans. The system expanded dramatically during the Great Depression and World War II, with top rates reaching 94% by 1944. The post-war period brought various reforms, including President Reagan’s Tax Reform Act of 1986 that simplified the tax code and lowered rates.

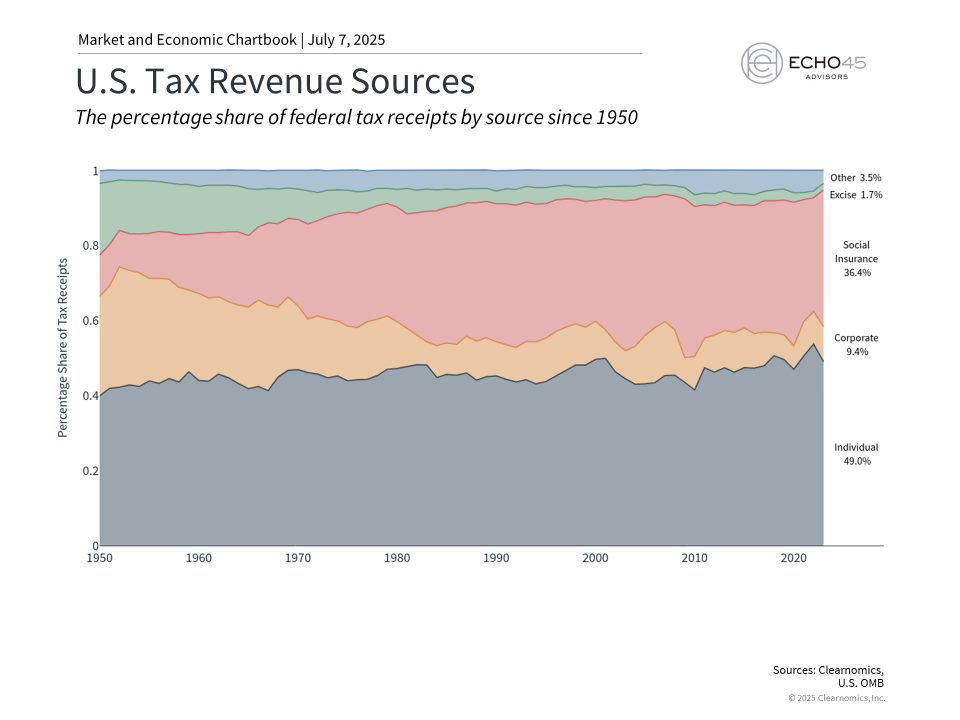

The situation has changed significantly in the intervening years. As the accompanying chart above shows, individual income taxes now represent the primary source of federal revenue. Social insurance taxes, also known as payroll taxes, are withheld from wages and help to pay for Social Security, Medicare, unemployment insurance, and other programs. Other sources of revenue are much smaller in proportion and include corporate taxes, which were reduced by the TCJA, and excise taxes, such as tariffs.

For investors, tax policies can certainly have direct implications on financial plans and portfolios. From a macroeconomic perspective, however, fiscal implications have more limited effects. Over longer periods, higher debt levels can influence interest rates and inflation expectations. While these factors have been relatively high in recent years, many of the worst-case scenarios have not yet occurred. The key for long-term investors is to maintain diversified portfolios that can perform across different fiscal and economic environments, rather than reacting to policy changes alone.

The bill continues the higher estate tax exemption limit

One set of provisions that would have been at the center of a tax cliff is the estate tax exemption. The TCJA doubled these limits which were scheduled to revert to previous levels this year. However, the passage of the new tax bill makes these higher exemptions permanent, further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

While it may seem like estate taxes only apply to higher net worth households, the reality is that all families must consider how assets can be passed to future generations. This requires a holistic approach that integrates estate planning, tax efficiency, philanthropy, and long-term family wealth preservation goals. It’s also important to keep in mind that individual states can also impose estate taxes with exemption thresholds that are less favorable than the federal level.

The bottom line? The new spending and tax bill extends and expands the current low-tax environment. For investors, a properly constructed financial plan is designed with these tax provisions in mind. When it comes to growing deficits and the national debt, it’s important to not react with our portfolios, but to maintain a longer-term perspective.

Echo45 Advisors LLC is a Registered Investment Advisor. Registration does not imply any level of skill or training. The information and statistics in this report has been obtained from Clearnomics, a separate and unaffiliated organization. Based on our own due diligence, we believe Clearnomics to be reliable but we do not warrant their accuracy or completeness. This report is for your information only and does not constitute an offer to buy or sell, or the solicitation of any offer to buy or sell any securities. Advisory services are only offered to clients or prospective clients where Echo45 Advisors LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Echo45 Advisors LLC unless a client service agreement is in place.

© 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.